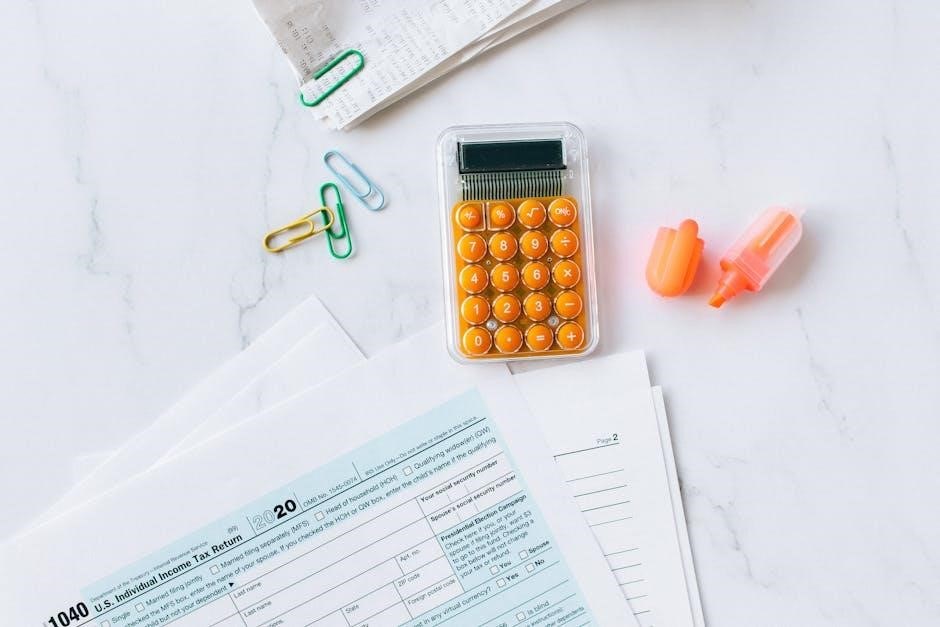

An Income and Expenditure Form is a document used to detail income sources and monthly expenses, essential for financial planning, budgeting, and credit assessments. It helps track financial health.

Understanding the Purpose of Income and Expenditure Forms

The primary purpose of an Income and Expenditure Form is to provide a clear overview of an individual’s or household’s financial situation. It helps in tracking income sources and monthly expenses, enabling effective budgeting and financial planning. This document is often required by financial institutions to assess creditworthiness and determine the ability to manage debts. By detailing income and outgoings, the form aids in identifying areas for cost reduction and improving financial stability. Regular updates to the form ensure accuracy as financial circumstances change, making it a valuable tool for long-term financial management and decision-making. Its structured format simplifies complex financial data for better understanding and planning.

Personal Details Section

The Personal Details Section requires basic information such as name, occupation, and contact details. Accurate disclosure ensures proper identification and verification for financial assessments and record-keeping purposes.

Importance of Accurate Personal Information

Accurate personal information is crucial for verifying identity and ensuring credibility. It helps institutions assess financial standing and process applications efficiently. Incomplete or incorrect details may lead to delays or rejections. Providing truthful and up-to-date data fosters trust and transparency, essential for financial evaluations. Additionally, it ensures compliance with legal and regulatory requirements. Proper disclosure aids in tailoring financial advice and solutions to individual circumstances. Accuracy also prevents potential disputes or misunderstandings. Overall, precise personal information is foundational for effective financial planning and decision-making, making it a critical component of the income and expenditure form.

Income Section

The Income Section is crucial for documenting all monthly earnings, ensuring accuracy in financial planning and assessment. It aids in understanding one’s financial standing and budgeting effectively.

Detailing Monthly Income Sources

Detailing monthly income sources involves listing all earnings, including wages, salaries, self-employment income, and any other regular payments. This ensures a comprehensive understanding of financial inflows, aiding in accurate budgeting and financial planning; By categorizing income, individuals can identify primary and secondary revenue streams, which is vital for managing expenses effectively. The income section typically requires specifying the frequency and amount of each income source, providing a clear overview of one’s financial standing. This step is essential for creating a realistic budget and making informed financial decisions. Accurate documentation of income sources is crucial for both personal and institutional financial assessments.

Calculating Total Monthly Income

Calculating total monthly income involves summing all income sources, including wages, salaries, freelance earnings, and investments. This step ensures an accurate overview of financial inflows, crucial for budgeting. By adding each income source, individuals can determine their total monthly earnings, which is essential for financial planning. This calculation helps in understanding disposable income and enables better management of expenses. Accuracy is key to avoid financial mismanagement. The total monthly income serves as the foundation for creating a balanced budget and assessing financial health. Regularly updating this figure ensures financial plans remain relevant and effective. This process is vital for both personal and institutional financial assessments.

Expenditure Section

The Expenditure Section details all monthly household expenses, including utilities, groceries, and debt payments. It helps track and manage financial outgoings effectively for better budget planning.

Categories of Monthly Household Expenditure

Monthly household expenditure is categorized into essential and discretionary spending. Essential expenses include housing, utilities, groceries, transportation, and insurance. Discretionary spending covers entertainment, personal expenses, and hobbies. Additional categories may involve debt repayments, healthcare, and education costs. Accurate categorization helps in understanding spending patterns and prioritizing financial obligations. Proper tracking ensures effective budget management and financial stability.

Tracking and Calculating Total Monthly Outgoings

Tracking monthly outgoings involves listing all expenses, including essential and discretionary spending, to calculate the total amount spent. This process helps identify spending patterns and ensures accurate financial reporting. By categorizing expenses, individuals can better manage their resources and make informed decisions. Summing up all outgoings provides a clear picture of total monthly expenditure, which is crucial for budget planning and financial stability. Regularly updating this information ensures that the financial records remain current and reflective of changing circumstances.

Assets and Liabilities Section

This section details owned assets, such as cash, shares, and property, alongside liabilities like loans or debts. It provides a clear view of financial standing for credit assessments.

Listing Assets Such as Cash and Shares

When listing assets such as cash and shares, it’s essential to provide accurate details. Cash includes savings and readily available funds, while shares are listed with their current market value. This helps in assessing overall financial stability and is crucial for credit evaluations. Proper documentation ensures transparency and builds credibility. By detailing each asset, individuals can demonstrate their financial capacity effectively. This section is vital for understanding one’s net worth and making informed financial decisions. Ensure all information is up-to-date to reflect the current financial position accurately.

Declaring Liabilities and Outstanding Debts

Declaring liabilities and outstanding debts is crucial for a comprehensive financial assessment. This section requires detailing all debts, including loans, credit cards, and mortgages, along with their outstanding balances and monthly payments. Accurately reporting liabilities ensures a clear understanding of financial obligations and helps in evaluating creditworthiness. Failure to disclose debts can lead to incomplete or misleading financial profiles. By listing all liabilities, individuals can better manage their financial responsibilities and plan budgets effectively. This transparency is essential for creditors and financial institutions to assess repayment capacity and make informed decisions. Ensuring accuracy in this section is vital for maintaining financial integrity and trust.

Budget Planning

Budget planning is essential for managing finances effectively, helping individuals allocate income wisely and track expenses to achieve financial stability and meet long-term goals successfully.

Using the Form to Create a Monthly Budget

Using the Income and Expenditure Form, individuals can systematically analyze their financial inflows and outflows to create a realistic monthly budget. By detailing income sources and categorizing expenses, users can identify spending trends and allocate funds effectively. This process helps in prioritizing essential expenses over discretionary ones, ensuring financial stability. The form also allows for setting clear financial goals, such as saving for emergencies or reducing debt. Regularly updating the form enables users to monitor their progress and make necessary adjustments. This structured approach fosters disciplined financial management and supports long-term economic well-being.

Strategies for Managing Income and Expenditure

Effective management of income and expenditure involves prioritizing essential expenses, allocating funds wisely, and adhering to a budget. Start by categorizing spending into needs and wants, ensuring essential expenses like housing, utilities, and food are covered first. Implement the 50/30/20 rule: 50% for necessities, 30% for discretionary spending, and 20% for savings or debt repayment. Automate savings to build an emergency fund and reduce impulsive purchases. Regularly review and adjust the budget to reflect changes in income or expenses. Tracking expenses through the Income and Expenditure Form helps identify areas for cost reduction, promoting financial stability and long-term security.